Zambia’s Emerald Mining

Derrick Silimina

Zambia is the world’s second-largest producer of emeralds, after Colombia. It is also home to the world’s largest emerald mine – Kagem, located in the southern part of Zambia’s copper belt and majority-owned by UK-based Gemfields. The Kagem mine accounts for 25 per cent of global production of the green gemstone.

Yet Zambia is well falling below its potential in emerald mining. It has hundreds of dormant small-scale emerald mines in its mineral-rich north-central region. And despite official outreach efforts, the country is not attracting large-scale foreign investment. In the words of an official of the Zambia Chamber of Mines, foreign investors are “hardly beating down the door” to develop Zambia’s emerald resources.

In an effort to turn the situation around, in January 2020 the government suspended a 15 per cent export tax on precious and semi-precious coloured gemstones. The export tax had been in effect for only one year. The industry cheered the tax break. “This move should attract more investors, so that small-scale miners can better contribute to the economy,” says Victor Kalesha, secretary-general of the Emerald and Semi-Precious Stones Mining Association of Zambia, known as Esmaz. “Most of the dormant gemstone mines could be revived” if the government does more to attract investors, he adds.

“We want to thank the government for suspending the export tax,” says Carol Sampa , general manager of Grizzly Mining Ltd., the country’s second largest producer of precious stones. The suspension of the export tax should help Zambia to compete with other gemstone producing countries, such as Colombia and Brazil, which do not impose such a tax.

According to Sampa, a boost in the emeralds sector will benefit the national treasury. For example, her company paid more than $42 million in taxes over the past five years. “I particularly want to highlight our tax contribution in 2019, which we made despite the export tax, which hurt our liquidity” she says.

Tax contributions such as those of her company show that Zambia should focus on developing other minerals beyond its large copper resources, she adds. The government seems to agree. “We want to broaden the tax base,” says Paul Kabuswe, minister of mines and minerals development. “Right now, the treasury is constrained because it relies on too few tax-paying mining companies. In the gemstone sector, we have only two operating companies – Gemfields and Grizzly – although we have issued many mining licenses in Copperbelt Province.”

Kabuswe notes that more than 500 locally-owned, small-scale emerald mines are dormant. He says he wants to focus on helping them, rather than on granting operating licenses to big foreign companies. “As a government, we want to ensure that all dormant mines start operating,” he says. “We are looking at tax incentives, especially for local mine owners. This would help them to attract capital investors and start mining. Partnership between local owners and foreign and domestic investors is the way to go.”

-- Project Syndicate

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

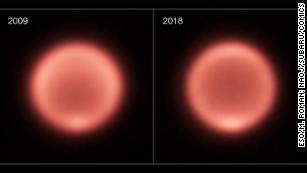

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

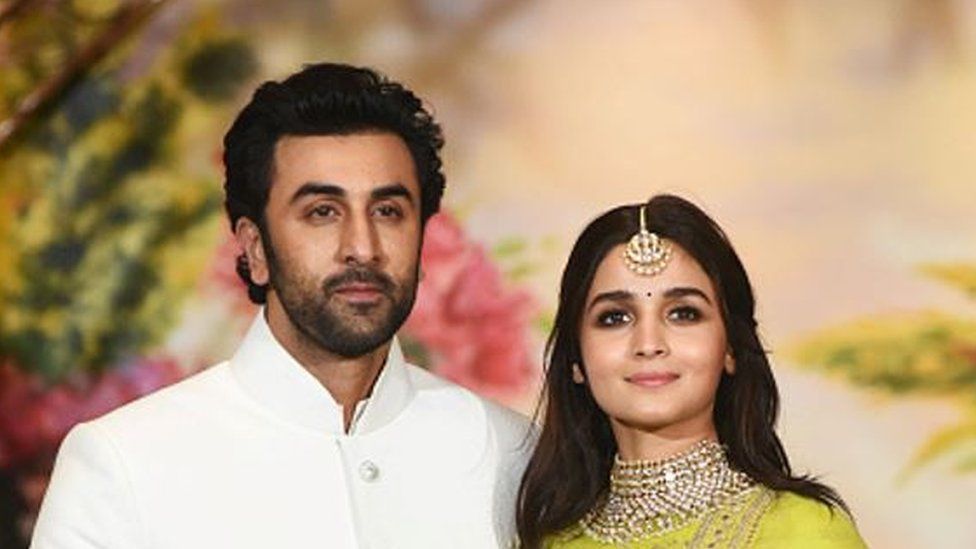

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022