Inflation hurts consumers, remittance shrinks

By A Staff Reporter

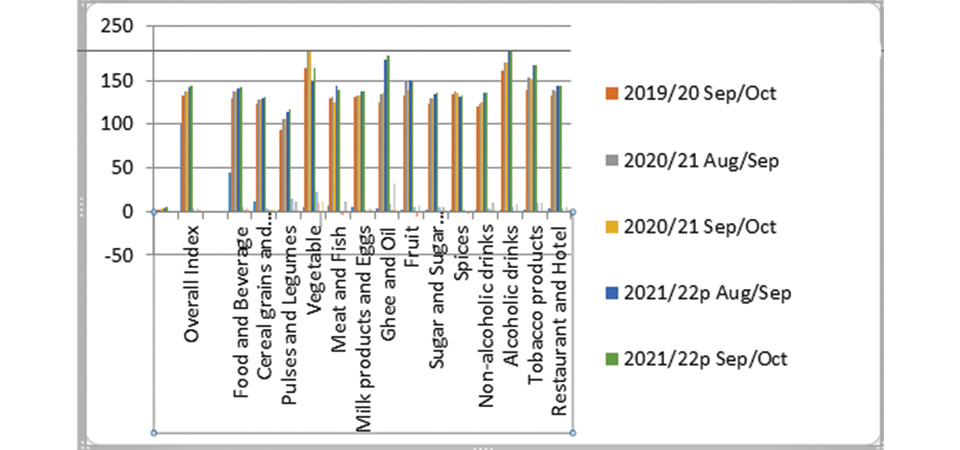

Kathmandu, Nov. 17: The consumer price inflation has increased in the first three months of the current fiscal year 2021/22. According to the current macroeconomic and financial report published by Nepal Rastra Bank (NRB) on Tuesday, the year-on-year (y-o-y) consumer price inflation stood at 4.24 per cent in the third month of 2021/22 compared to 3.79 per cent a year ago.

Food and beverage inflation stood at 3.63 per cent whereas non-food and service inflation stood at 4.72 per cent in the review month.

The price of ghee and oil, meat and fish, pulses and legumes, tobacco products and non-alcoholic drinks sub-categories rose by 31.68 per cent, 11.93 per cent, 10.71 per cent, 10.12 per cent and 9.63 per cent respectively on y-o-y basis.

In the review month, the Kathmandu Valley, Terai, Hill and Mountain witnessed 3.48 per cent, 4.01 per cent, 5.68 per cent and 3.12 per cent inflation respectively.

Inflation in these regions was 3.35 per cent, 4.46 per cent, 3.03 per cent and 4.39 per cent respectively a year ago.

The y-o-y wholesale price inflation stood at 3.83 per cent in the review month compared to 8.26 per cent a year ago.

The y-o-y wholesale price of consumption goods, intermediate goods and capital goods increased by 2.11 per cent, 4.55 per cent and 5.86 per cent respectively, NRB said.

The wholesale price of construction materials has increased by 12.32 per cent in the review month.

The y-o-y salary and wage rate index increased by 4.92 per cent in the review month.

BoP remained at deficit of Rs. 76.14 billion

Meanwhile, balance of payments (BOP) remained at a deficit of Rs.76.14 billion in the review period against a surplus of Rs. 101.09 billion in the same period of the previous year.

In the US dollar terms, the BOP remained at a deficit of 643.1 million in the review period against a surplus of 851.0 million in the same period of the previous year.

Similarly, the current account remained at a deficit of Rs.151.70 billion in the review period against a surplus of Rs. 33.38 billion in the same period of the previous year.

In the US dollar terms, the current account registered a deficit of 1.28 billion in the review period against a surplus of 279.9 million in the same period last year.

In the review period, capital transfer decreased by 45.9 per cent to Rs. 1.92 billion but net foreign direct investment (FDI) increased by 73.5 per cent to Rs.5.07 billion, report said. In the same period of the previous year, capital transfer and net FDI amounted to Rs. 3.56 billion and Rs. 2.92 billion respectively.

Remittance inflow down by 7.6%

The remittance inflows decreased by 7.6 per cent to Rs. 239.32 billion in the review period against an increase of 12.7 per cent in the same period of the previous year.

In the US dollar terms, remittance inflows decreased by 7.7 per cent to 2.02 billion in the review period against an increase of 7.6 per cent in the same period of the previous year.

Number of Nepali workers (institutional and individual-new and legalised) taking approval for foreign employment increased significantly to 66,316 in the review period.

It had decreased by 96.8 per cent in the same period of the previous year.

The number of Nepali workers (Renew entry) taking approval for foreign employment increased significantly to 34,823 in the review period.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022