NRB approval not mandatory for foreign investment

By Laxman Kafle

Kathmandu, June 9: Nepal Rastra Bank (NRB) has unveiled ‘NRB Foreign Direct Investment and Loan Management Bylaw, 2078’ Tuesday. Through the bylaw, NRB has facilitated the inflow of foreign investment without the approval of the central bank.

As per the bylaw, it will not be mandatory for the foreign investor to obtain prior approval from the NRB to send or remit foreign currency to Nepal after obtaining foreign investment approval from the foreign investment sanctioning body.

However, it is mentioned in the bylaw that after the investment is approved written information should be given to NRB before bringing or sending foreign currency.

Governor of Nepal Rastra Bank Maha Prasad Adhikari said that the bylaw would make it easier for investors.

"NRB has facilitated the process of attracting and receiving foreign investment, which will make it easier to bring foreign investment," said Adhikari.

The provision has been made in the bylaw that prior approval of investment in dollars or approval of NRB is not mandatory for foreign investors interested in sending / bringing foreign currency required for registration of industries and conducting feasibility study to Nepal through the banking system.

The provision has been made to calculate the expenditure on foreign investment of companies and industries which invested in foreign currency as certified by the auditor, so as not to exceed 3 per cent of the paid up capital of the company and industry.

Its accounting shall be done in accordance with Regulation 5.

However, in case of non-receipt of foreign investment or if the amount is more than the amount calculated in foreign investment, such amount cannot be refunded.

Banks and financial institutions may deposit in the account of interested foreign investors or their official local representative.

Banks and financial institutions will have to take letter from foreign investors and their official local representatives who are willing to deposit the amount.

The NRB has also facilitated foreign exchange to repatriate foreign investment and earned money.

The NRB has improved investment accounting through the bylaw.

Once the investment is received, it should be accounted in NRB. If there is no accounting before, now a period of one year will be given by issuing a notice. The accounting has to be completed within seven days of the completion of the documents.

In case of taking foreign loan, prior approval of NRB is required.

Except as exempted by the prevailing law, Nepali individuals, firms, companies, banks and financial institutions and other organisations have to take prior approval of NRB in case of borrowing in Indian Rupees or convertible foreign currency from outside Nepal.

Approval will be provided within 15 days. Debt accounting should be done within six months.

If the loan has been paid by fixing the payment schedule, the payment will be made from the bank and financial institution. There is no need to go to NRB in this regard.

NRB has expected that doing business will be faster and improved following the implementation of this bylaw.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

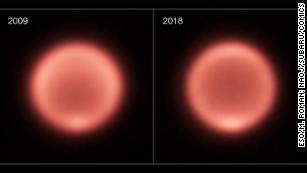

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

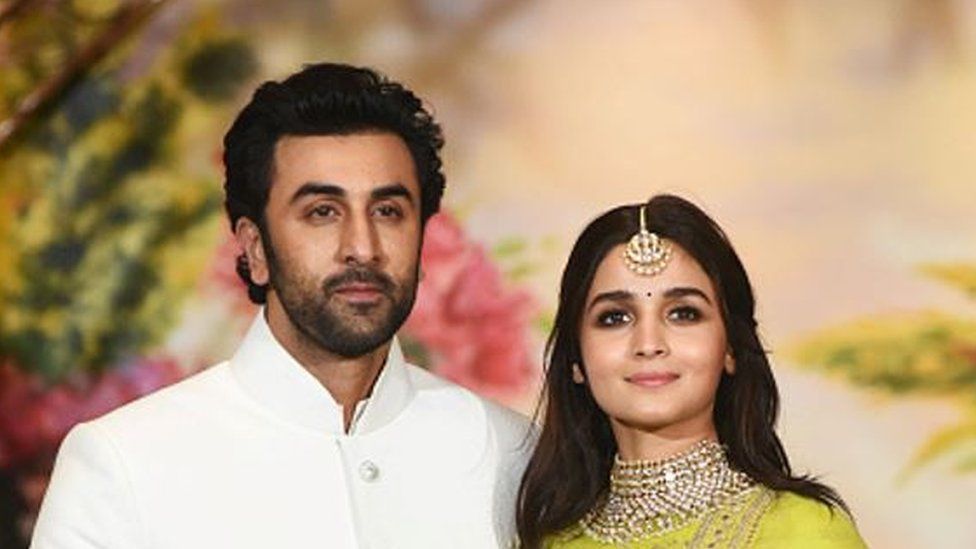

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022