Deposits collection in BFIs goes up by 9.2%

By A Staff Reporter

Kathmandu, Feb.12 : Deposit collection by the Banks and Financial Institutions (BFIs) has increased by 9.2 per cent in the first six months of the current fiscal year 2020/21.

The collection growth was 6.2 per cent in the corresponding period last fiscal year.

On year-on-year (y-o-y) basis, deposits in the BFIs expanded by 22 per cent by mid-January this year.

The share of demand, savings, and fixed deposits in total deposits stands at 8.5 per cent, 33.6 per cent and 49.2 per cent respectively in mid-January 2021, according to the latest macroeconomic and financial report of the Nepal Rastra Bank.

Such shares were 8.5 per cent, 31.9 per cent and 49.2 per cent respectively a year ago.

The share of institutional deposits in total deposit of the BFIs stands at 42.5 per cent in mid-January 2021. Such share was 45.1 per cent in mid-January 2020.

In the meantime, private sector credit from the BFIs increased by 11.4 per cent during the review period compared to a growth of 8.6 per cent in the corresponding period the previous year.

On y-o-y basis, credit to the private sector from the BFIs increased by 14.9 per cent in mid-January 2021.

In the review period, private sector credit from commercial banks, development banks and finance companies increased by 11.3 per cent, 15.3 per cent and 0.3 per cent respectively.

Of the total outstanding credit of the BFIs, 66.3 per cent is against the collateral of land and building and 12.2 per cent against the collateral of current assets (such as agricultural and non-agricultural products).

Outstanding loan of the BFIs to agriculture sector increased by 20.2 per cent, industrial production sector increased by 6.9 per cent and construction sector went up by 6.3 per cent.

Similarly, loan of the BFIs to transportation, communication and public sectors increased by 6.9 per cent, wholesale and retail sector increased by 9.5 per cent and service industry sector increased by 11.9 per cent in the review period.

In the review period, term loan extended by BFIs increased by 11.5 per cent, overdraft increased by 13.4 per cent, demand and working capital loan increased by 13.6 per cent, real estate loan increased by 4 per cent, margin nature loan rose by 50.2 per cent and trust receipt (import) loan increased by 5.6 per cent while loan of hire purchase fell by 4.4 per cent.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

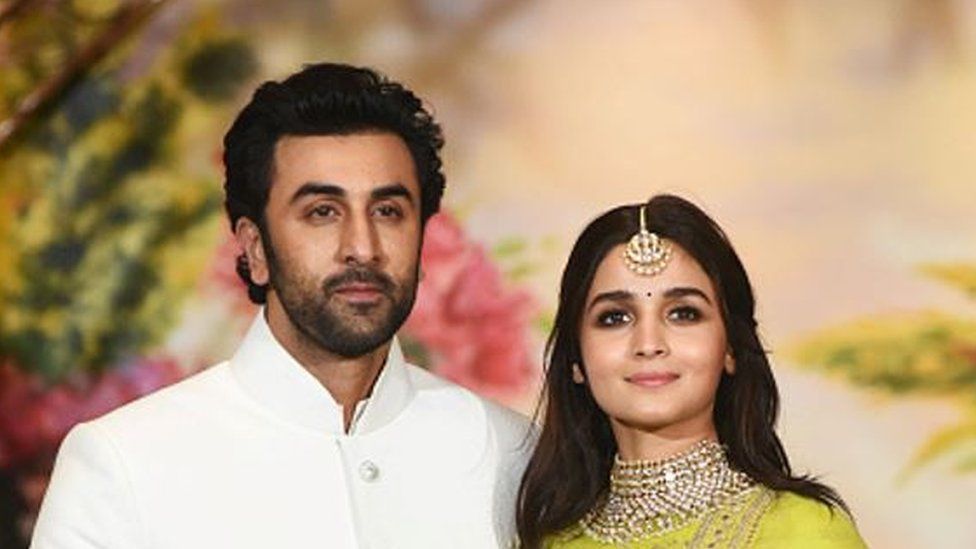

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022