Lower Interest Rates To Spur Growth

Tom Fowdy

The global economy has hit headwinds. Although 2021 began with a great deal of optimism in the view of a recovery from the COVID-19 pandemic, by the end of the year that picture has dampened significantly. Not only have vaccinations failed to offset the pandemic as many had hoped, the new and dangerous Omicron variant has rattled global markets and confidence. In addition, recovering economies have found themselves simultaneously battered by soaring inflation and commodity prices as well as supply-chain bottlenecks, which has resulted in some countries raising interest rates. It is unsurprising that GDP projections for major economies and the world have started to be revised downwards.

China faces its own unique circumstances. Because of its rapid recovery from the pandemic in the previous year, it has persistently been ahead of the curve compared to other major economies. It is expected to end 2021 with GDP growth between 7-8 per cent, although its score for the previous year was revised downwards to 2.1 per cent. Despite this, it still faces a number of challenges such as production and commodity costs, as well as the debt issue in the real estate market.

As a result, in contrast to the rest of the world, China's central bank recently cut a benchmark lending rate, the "one-year loan prime rate" (LPR), to 3.8 per cent from 3.85 per cent. The previous week it also cut the minimum amount of cash that banks have on reserve.

The LPR sets the lending rates for corporate and household loans. In theory, a lower interest rate helps boost economic growth by making credit more affordable to recipients, subsequently adding liquidity to the economy. On the other hand, it also comes with the risk of heightening inflation.

It is no coincidence that on hearing the news, shares of Chinese developers have surged, even hitting "limit up" counters on December 21.

But this is a sign of strength for China. Unlike countries such as the U.K. and the U.S. which sought to offset massive economic damage from the pandemic by resorting to immense amounts of stimulus and lending (the highest since WW2), China's 2020-2021 recovery was built on a conservative fiscal policy that leaned upon stability and avoided stimulus. In other words, it was natural. The last time China took such a policy was to offset the financial crisis of 2008, when it injected $586 billion into the economy.

In Western countries, the enormous injection of stimulus has not only seen public debt skyrocket, but combined with previously record low-interest rates, is the primary catalyst of surging inflation in the context of pandemic disruptions which are not yet over. This is what is known as "overheating the money supply." As a result, these countries are being forced to put up interest rates in order to cool massive economic imbalance, which in turn then stifles economic growth even further.

Effectively, countries such as the United Kingdom have pursued a highly unbalanced recovery. Therefore, even before the interest rate rise, month on month GDP growth had fallen to just 0.1 per cent – far less than expected. The U.S. is likewise expected to pursue an interest rate rise in early 2022.

However, China is continuing an economic policy which focuses on long-term gains. The country is currently at the end of a natural recovery cycle and is facing some disruptions, therefore, slightly lowering interest rates will help growth continue as well as ease problems in the property sector, without resorting to unsustainable and dangerous methods. As such, China is managing its economy with caution and prudence, so as to continue to grow in a balanced manner.

-- China.org.cn

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

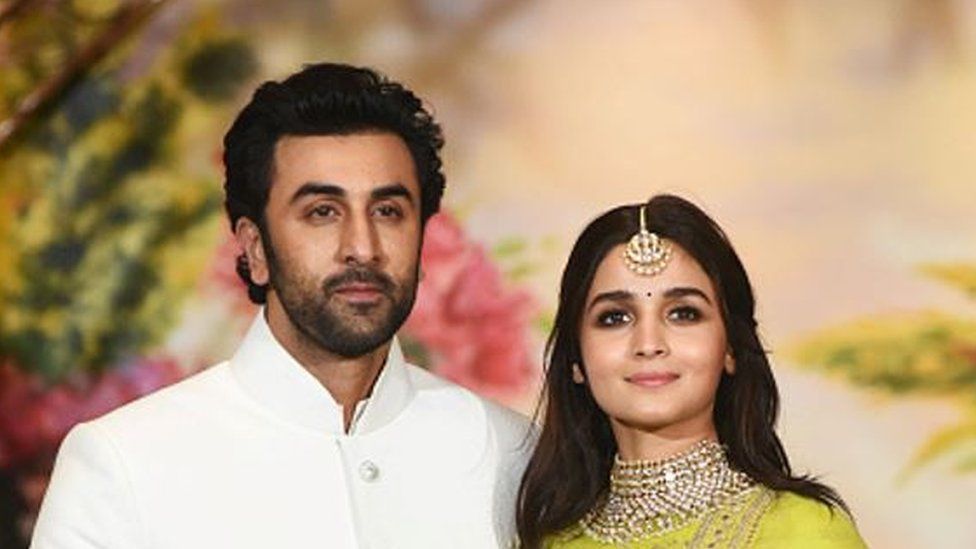

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022