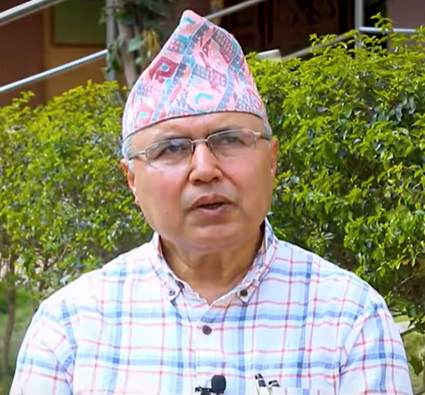

Liquidity shortage will not affect economic growth: Khanal

Rameshor Khanal is the former finance secretary of the government of Nepal. As the finance secretary, Khanal is appreciated for taking initiative for reforms in government accounting and reporting, public procurement, and tax policy. He has been advocating for advancing regional integration and cooperation in South Asia. Given the present situation of a liquidity shortage, Ajay Chhetri of TRN Online talked with former secretary Khanal about its causes and ways of solution.

Excerpts:

What is your analysis of the current situation of the liquidity shortage?

To understand the current liquidity situation (shortage of liquidity) you have to understand how currency floats in the market. Cash comes into the hand of people for economic transactions when Nepal Rastra Bank (NRB) floats currencies in the financial system. For this process, people from abroad submit foreign currencies in the NRB. The NRB keeps foreign currencies and provides Nepali currencies, this is how currencies float out in the domestic market. So if people exchange more foreign currencies, then more domestic currencies float out in the market. This is one of the first processes.

In the second type of process, government issues debt bills. This will be purchased either by banks and financial institutions or general people. The currency collected from the debt bill will go into the government treasury and this currency is again spent by the government and the currency goes into the hand of the general public.

The third process is, the NRB is the banker of the banks. If more currencies are needed by the banks and financial institutions, the NRB can print out the currencies and provide them to the financial institutions for quantitative easing.

In recent times, the NRB is providing liquidity using a monetary instrument like a stand liquidity facility (SLF).

If all this process is disrupted, there will be a creation of liquidity shortage.

Now, the current shortage of liquidity is driven mainly by two reasons. First, an outflow of foreign currency -domestic currency reserves in the central bank to exchange foreign currency -is greater than its inflow. Second, the government couldn't spend all the revenue it has collected, which led to a large sum of money collected as revenue being held up in the government account in the central bank. It is known as monetary shrinkage, and the monetary instruments are not getting effective as the government is not able to raise expenditure.

Additionally, the third one might be, politicians, holding back cash in hand from December to get prepared for the upcoming elections as politicians are restricted to spending a limited amount of money in elections. But its volume may be small. The other reason may be the use of foreign currencies for illegal imports (foreign currency that is supposed to be remitted in Nepal are being spent in Malaysia, Qatar to purchase luxurious goods like iPhone, electronic goods, gold, silver as NRB took tighter policy for the imports of such items). Another factor that has created a shortage of foreign currency is, the tourism sector used to contribute around Rs. 150 to 200 billion each year and approximately 50 per cent of the earnings come in foreign currency. It contributes approximately around 7 per cent to 8 per cent in our economy. It has fallen after the COVID-19 pandemic.

Similarly, foreign grants shrank as grants in the pipeline got held back due to the weak capacity of the government to enhance prompt use of the foreign grant. It also hit out in the liquidity. Bankers have intensified lending on consumable goods rather than on economic activities that boost the economy, it has encouraged the consumption of fuel and vehicles which has impacted the liquidity.

What role could be used to ease the shortage of liquidity?

The government should have used the liquidity easing instrument in August, specifically, flexibility in interest adjustment should have been adopted in August. The stance to keep the interest rate in a single-digit has created current problems. Only if the situation gets worse, the government could use a stimulus package. However, the current situation is not like that. In addition to it, the government has not been able to spend expenditures envisaged in the budget.

The government should strictly take steps to push up capital expenditure as aimed in the budget and implement it effectively.

What is your analysis of the economic growth rate in the current FY given the context of liquidity shortage?

In the Nepali economy, agriculture is one of such sectors that remain unaffected during the shortage of liquidity. It contributes to approximately around 26 to 27 per cent in our economy. Mobilization of liquidity in this sector is comparatively very low. The other is the service sector like village school, education which contributes to around 7 per cent in the economy. The service sector is not affected by a shortage of liquidity.

In our economy, trade is mainly such a sector that gets affected during the shortage of liquidity. It contributes approximately 16 to 17 per cent. Similarly, the industry contributes approximately around 5 to 6 per cent. Shortage of liquidity mainly hits this trading sector that is contributing 13 to 14 per cent to our economy. This sector possesses a greater voice and pitches more so it gets heard loud. However, 60 per cent of the farmers that are contributing more to the economy never complain of the shortage of liquidity. The shortage of liquidity will not affect economic growth.

International agencies like World Bank adopt a conservative method for the projection of the economy. Projection of economic growth using the income approach is complicated as data is not available. The economy will grow approximately by 5 to 5.2 per cent if it is estimated from the expenditure method and if the season remains favourable for the crops.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022