Women Shine In Capital Market

Sampada A. Khatiwada

The craze of Nepal's capital market has grown across the nation in recent times. With every public company issuing Initial Public Offerings (IPOs) and setting a record high number of applicants, it can be ascertained that people are now being well aware of the concept of financial independence and are striving to increase financial literacy to attain independence.

According to a report issued by the Securities Board of Nepal on the occasion of its 29th anniversary a few months ago, the number of Mero Share accounts has surged to 2.6 million from 700,000 and Demat accounts have doubled to 4.3 million in the span of one year.

It is even more refreshing to see that the number of women stock traders is also increasing significantly lately. As reported by CDS and Clearing Limited, of the 4,346,923 Demat accounts, 1,836,948 accounts are of women. i.e., 42 per cent of total Demat accounts and 45 per cent of Mero Share accounts belong to women.

Moreover, as per a report published in Forbes Advisor on March 2021, studies have shown that women could excel in trading as they achieve proper diversification to help protect their money regardless of the market condition.

In the present context where equal participation of women is limited only within legal provisions in the areas such as bureaucracy, politics, and private sector, women making almost equal presence as men in stock market trading is exemplary. This shows that along with managing their work and household chores, women are adept at playing many roles - be it investor, crisis manager or risk-taker and what not!

Thanks to the advancement of technology and increased access to mobile phones and the internet, not only women of young age, mid-aged women, and even housewives are thriving in the capital market with a few taps on their phones.

While women population across the globe is striving for equal leadership roles in every sector and against the gender pay gap, Nepali women are breaking the glass ceiling with their yearning for financial knowledge and inherent independence. They have set an example that women can also be the breadwinners of the family as they are not only conditioned to save, but also to invest and expand.

Appreciating women's willingness to thrive in the capital market, the government, broker companies, and all other stakeholders can conduct financial literacy training under their Corporate Social Responsibility (CSR) targeted to women to channelise their risk-averse nature, which is beneficial to survive in the share market. Conducting training to enhance women's research skills and encouraging more women from all over the country to invest in the stock market can be an important tool to empower women and to ensure their access to financial freedom.

After all, as women constitute half of our nation's population, the participation of women is imperative in strengthening the nation's economy.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

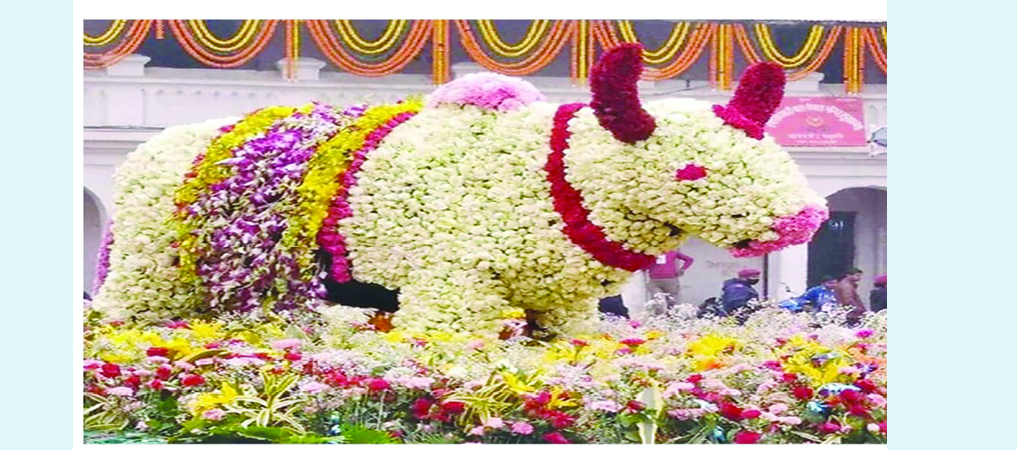

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022