‘Liquidity crunch needs permanent solution’

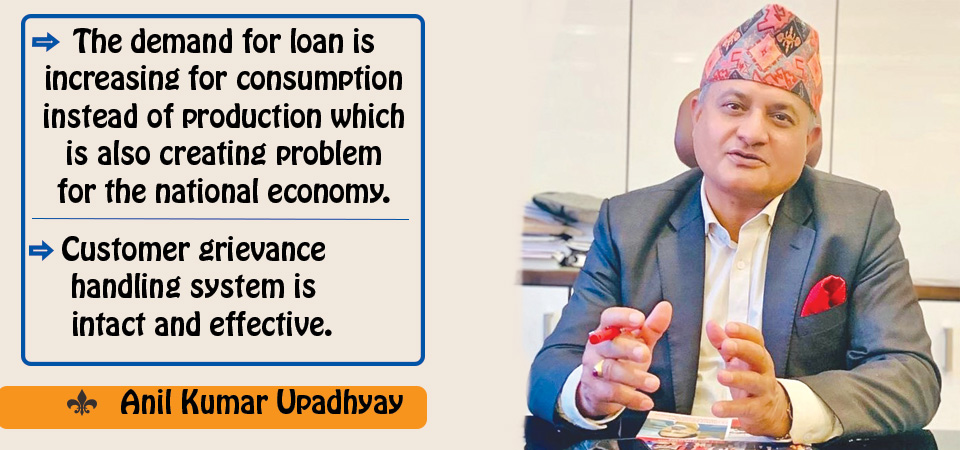

Banking sector in Nepal has been experiencing a liquidity shortage for the past few months. All BFIs have been unable to provide loans to individuals and businesses in lack of cash flow. Again, the inflow of remittance has been declining and has been poor. Foreign currency reserves have declined significantly and Balance of Payment (BoP) has been in deficit. Nepali economy is facing these challenges at a time when efforts are imperative to revive it from the impact of the COVID-19 pandemic. In this context, Nepal Bankers’ Association (NBA) President and Chief Executive Officer (CEO) of Agricultural Development Bank Limited (ADBL) Anil Kumar Upadhyay talked about challenges and prospects of the banking sector with Laxman Kafle of The Rising Nepal. Excerpts:

How is the liquidity situation in the banking sector now? What factors are contributing to the liquidity crisis?

Definitely, the banking sector is now under the pressure of liquidity. After the COVID-19 pandemic, there has been an aggressive expansion of credit to overcome the high liquidity situation, but deposit mobilisation has not been as it should have been.

Out of the target of 20 per cent credit expansion of Rs. 786 billion this fiscal year, about Rs. 500 billion has been extended since July last year. But deposit collection has increased by only Rs. 130 billion. The growth of consumption loan has also increased tremendously. Consumption loan has increased by 250 per cent to Rs. 823 billion while construction loan has declined by 49 per cent to Rs. 210 billion in six months.

This has also put pressure on liquidity. Low growth in deposits, reduction in remittances, poor government capital expenditure, excessive pressure on imports, and lack of exports have invited the crisis in liquidity. The banking sector is under liquidity pressure for the last one decade except for a short span after 2015 earthquake. Liquidity problems are being solved by the NRB temporarily by applying different measures. But they should be solved permanently by developing resources and increasing investment in productive sector.

Now, when the half-yearly review of monetary policy is going to take place, NRB should focus attention to address the present liquidity problem in order to fulfill the demand for credit.

How have you assessed the impact of COVID 19 on Nepal’s financial sector?

Repeated lockdowns imposed to control COVID-19 have badly affected our economy. The World Bank has forecast that the economic growth rate will fall to 3.9 per cent from 7 per cent set by the government. There is a dearth of loanable fund for investment required for the revival of the COVID-19 affected economy.

The demand for loan is increasing for consumption instead of production which is also creating problem for the national economy. However, the BFIs are focusing on the investment in productive sectors, including agriculture, hydropower, industries and tourism following the directives of the regulating body. The NRB has also tightened import of unnecessary and less important goods. The present challenge facing our economy will persist until and unless the productive sectors become strong and capable.

Growing trade imbalance is another challenge. On a monthly basis, we import goods and services worth around Rs. 170 billion and export goods worth only around Rs. 20 billion. The remittance inflow has been declining. About Rs. 80 billion remittances enter the country on a monthly basis. That is why every month we are facing a deficit between of Rs. 70 and Rs. 80 billion. Our balance of payments is negative by about Rs. 240 billion and current account is in deficit by more than Rs. 354 billion. Foreign currency reserves are enough to support the import of only 6.6 months.

Interest rates have been stable for the last couple of months. Now, changes have been made in interest rates. What is the impact on deposits and loans?

Based on the benchmark (minimum and maximum) of interest rates fixed by the NRB, the NBA has opened the ceiling for interest rates on deposits. The banks should receive a deposit in the interest rates following the circular of the regulatory body. It means, banks can either increase or decrease between the maximum and minimum limits of interest on the deposit. From the new provision, the banks can take deposits in the existing interest rate. This decision will support deposit mobilisation as people will be encourage in saving. We have taken the decision on the provision of regulator to bring remittance through banking channel as well.

This provision will not affect the existing creditors now but the interest rate for new loans can increase. The interest rate for existing loans will be determined from the base rate which is revised by the banks every three months.

Even though NRB has been facilitating merger and acquisition with priority, the commercial banks are still unable to go for merger. Why?

The government has provisions for commercial banks to adopt universal and prudent banking practices through its five-year Financial Development Strategy. The NRB has promoted merger through several relaxations in monetary policy. There are certain issues that the commercial banks are facing. Power sharing, employee resource management, changed business strategies, shareholders’ expectations of dividend and swap ratio and tax related matters are the main problems.

Merger of big institutions is obviously complex as different business cultures and practices have to unite under the same family. We have to manage the composition, strengthen the banks as well as address the key issues for safe and sustainable merger. Merger is an ongoing process and system and equally important for banks to open branches in foreign countries by strengthening their capacity.

Remittance still enters Nepal through Hundi. What can be done to bring it through the banking channel?

Hundi, an illegal financial transaction, has a greater risk of losing the public money as it is an informal channel. During lockdown, hundi was discouraged due to travel restriction, disruption in supply chain mechanism and transportation issues. This is why the remittance inflow increased then. But now things have returned to normalcy. Only USD 1,500 is allowed for Nepalis travelling abroad, and it seems to be insufficient especially to students, so they manage it from hundi traders. Lack of financial literacy and investment of Nepalis in crypto currencies is another reason for the continuity of this illegal transaction.

The investments in cryptos, hyper fund and network marketing are illegal. Further, remittance deposits get additional 1 per cent extra interest. Now, it is 12.03 per cent. Long Term Foreign Employment Savings Scheme with attractive interest is also available. Public should be informed about these facilities. Financial Literacy Programmes need to be increased. Cooperation among the three parties -- banking, government and manpower companies -- could help channelise the remittance inflow. If we manage the payment system for the migrant workers, the remittance will come through the banking system by checking accounts of migrants.

Digital banking transactions have been increasing these days. What technologies have the banks adopted to keep the digital banking transactions secured?

Banks have fully secured Core Banking System. The central bank regulations also require the Banks and Financial Institutions for Annual Information System Audit. It checks flaws and anomalies in the system. Online Account Opening and E-KYC are made more secured through proper customer identification mechanism in online mode. There is 24/7 continuous monitoring of banking transactions. Customer grievance handling system is intact and effective. Banks should adopt modern technologies and software, and employees should be made accustomed to technology. Users should be careful and vigilant in digital and electronic transaction and not share confidential details related to transactions with unknown persons.

In the ADBL, we have international level fully secured intranet system where internet surfing, third-party web access and malicious sites have been totally blocked. Our Core Banking Software, Temenos T24 is one of the most secured systems in the world. We have regularly performed IS Audit, analysed and are continuously monitoring to effectively manage IT based risk. Further, our internal audit, internal inspection and control mechanism have been efficiently working to avert the risks, system and talents.

What is crypto currency and its importance? What are its challenges in Nepal?

It is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are channel forms networks based on block chain technology. The sharing system is of private keys and public ledgers to authenticate new transactions and create an encrypted log of past transactions. Cryptos encourage users to participate in the system by rewarding them with additional cryptos. They have an official wallet account, just like bank account, and can be purchased on open exchanges and use for transactions or convert into cash. Cryptos have benefits like they have little or no processing fees. Most cryptos are anti-inflationary, as they are in limited supply.

They can be traded around the world. Tax evasion through cryptos is also a major threat, they are not regulated by the central bank and government, so they challenge the government sovereignty and rights. Now, it is illegal transaction in Nepal. There is no official data, but large number of NRNs have invested in cryptos recently. It also has blocked remittance flow into Nepal. These transactions have high chances of grey zone, i.e., of money laundering and terrorist financing.

Debates also have been arising citing the Indian government’s recent policy to tax crypto gains at 30%. Nepal is import oriented economy and crypto investments don’t encourage productive sector investment in Nepal. First of all, we have to increase our foreign currency reserves, with exports. Once our foreign currency reserve increases significantly with stability, crypto legalisation can be a useful debate.

Recent News

Do not make expressions casting dout on election: EC

14 Apr, 2022

CM Bhatta says may New Year 2079 BS inspire positive thinking

14 Apr, 2022

Three new cases, 44 recoveries in 24 hours

14 Apr, 2022

689 climbers of 84 teams so far acquire permits for climbing various peaks this spring season

14 Apr, 2022

How the rising cost of living crisis is impacting Nepal

14 Apr, 2022

US military confirms an interstellar meteor collided with Earth

14 Apr, 2022

Valneva Covid vaccine approved for use in UK

14 Apr, 2022

Chair Prachanda highlights need of unity among Maoist, Communist forces

14 Apr, 2022

Ranbir Kapoor and Alia Bhatt: Bollywood toasts star couple on wedding

14 Apr, 2022

President Bhandari confers decorations (Photo Feature)

14 Apr, 2022